All About Paul B Insurance

Wiki Article

The Basic Principles Of Paul B Insurance

Table of ContentsThe 2-Minute Rule for Paul B Insurance5 Simple Techniques For Paul B InsuranceNot known Facts About Paul B InsuranceUnknown Facts About Paul B InsuranceThings about Paul B InsuranceThe Greatest Guide To Paul B Insurance

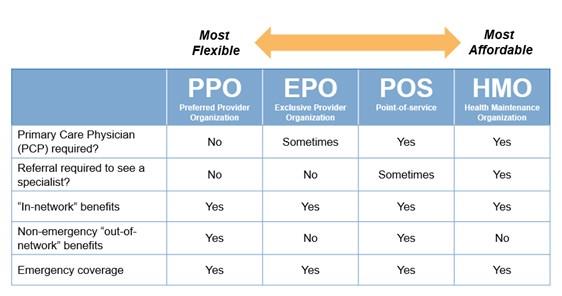

Related Subjects One reason insurance coverage issues can be so confounding is that the medical care market is frequently altering and also the protection intends used by insurance companies are hard to classify. In various other words, the lines in between HMOs, PPOs, POSs and various other sorts of insurance coverage are commonly blurry. Still, comprehending the make-up of various plan kinds will be handy in reviewing your choices.PPOs generally use a broader option of companies than HMOs. Costs may be comparable to or a little greater than HMOs, and also out-of-pocket costs are typically higher and also more challenging than those for HMOs. PPOs permit individuals to venture out of the copyright network at their discretion as well as do not call for a referral from a medical care medical professional.

As soon as the deductible amount is gotten to, added health expenditures are covered based on the stipulations of the health insurance plan. An employee might after that be liable for 10% of the prices for treatment obtained from a PPO network copyright. Deposits made to an HSA are tax-free to the employer and employee, and also money not invested at the end of the year may be rolled over to spend for future clinical costs.

Getting The Paul B Insurance To Work

(Particular restrictions might relate to highly made up participants.) An HRA should be funded only by a company. There is no restriction on the amount of money a company can add to staff member accounts, nevertheless, the accounts may not be funded through staff member salary deferments under a snack bar plan. In addition, employers are not allowed to reimburse any kind of component of the equilibrium to workers.

Do you know when one of the most fantastic time of the year is? No, it's not Christmas. We're speaking about open enrollment period, baby! That's! The wonderful season when you get to contrast health and wellness insurance prepares to see which one is best for you! Okay, you obtained us.

Little Known Facts About Paul B Insurance.

However when it's time to choose, it is very important to recognize what each plan covers, how much it costs, and where you can use it, right? This things can feel difficult, however it's less complicated than it appears. We assembled some useful knowing actions to assist you feel great about your options.(See what we did there?) Emergency situation treatment is usually the exemption to the regulation. These plans are one of the most popular for people who get their wellness insurance policy through work, with 47% of protected workers signed up in a PPO.2 Pro: A Lot Of PPOs have a good option of carriers to select from in your location.

Con: Greater costs make PPOs much more costly than various read this other sorts of plans like HMOs. A wellness maintenance company is a health insurance coverage plan that typically just covers treatment from physicians who benefit (or agreement with) that details plan.3 So unless there's an emergency situation, your plan will certainly not spend for out-of-network treatment.

Rumored Buzz on Paul B Insurance

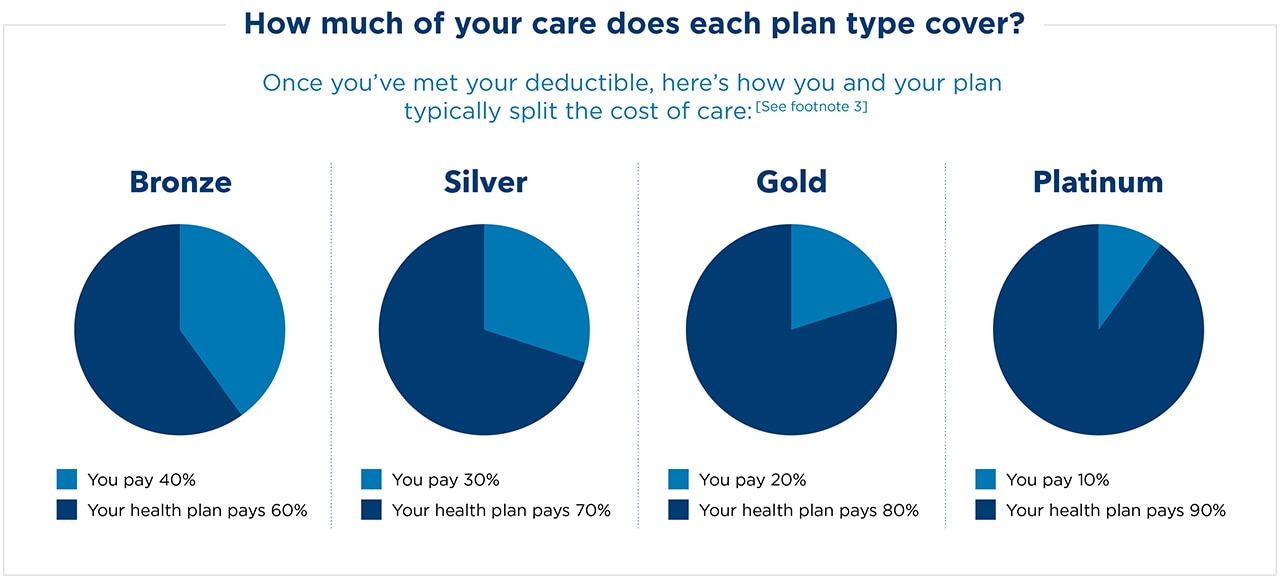

Even More like Michael Phelps. It's excellent to understand that plans in every category provide some kinds of totally free preventative care, as well as some offer free or reduced healthcare solutions before you fulfill your deductible.Bronze strategies have the most affordable monthly costs yet the highest out-of-pocket costs. As you work your method up through the Silver, Gold as well as Platinum classifications, you pay a lot more in costs, but less in deductibles as well as coinsurance. As we pointed out in the past, the additional prices in the Silver classification can be lessened if you certify for the cost-sharing reductions.

Decreases can lower your out-of-pocket healthcare costs a great deal, so obtain with among our Endorsed Regional Carriers (ELPs) who can help you discover out what you may be eligible for. The table below shows the percent that the insurer paysand what you find this payfor covered expenses after you fulfill your deductible in each plan classification.

An Unbiased View of Paul B Insurance

Various other expenses, frequently called "out-of-pocket" prices, can add up swiftly. Points like your insurance deductible, your copay, your coinsurance amount as well as your out-of-pocket maximum can have a big impact on the total cost.When picking your health insurance policy strategy, do not forget health care cost-sharing programs. These job quite much like the other health insurance coverage programs we described already, but practically they're not a form of insurance policy. Permit us to clarify. Wellness cost-sharing programs still have regular monthly costs you pay and defined insurance coverage terms.

If you're trying the do it yourself route and also have any type of lingering questions concerning medical insurance plans, the specialists are the ones to ask. And also they'll do greater than just address your questionsthey'll also find you the best price! Or possibly you would certainly such as a method to incorporate getting fantastic health care insurance read review coverage with the chance to assist others in a time of need.

Paul B Insurance Things To Know Before You Buy

CHM helps households share medical care costs like medical examinations, maternity, hospitalization and surgical treatment. Plus, they're a Ramsey, Trusted companion, so you recognize they'll cover the clinical bills they're meant to and recognize your insurance coverage.

Report this wiki page